A New Year, A Safer Place to Land: Starting Your Financial Story with Nick Stone & Skyler McCurine

By Cesar A Reyes

The new year has a way of stirring up equal parts hope and fear. Hope that this will finally be the year things feel more stable. Fear that maybe you’re already behind. For many people, especially within the LGBTQ+ community, money isn’t just stressful, it’s personal. It’s tied to safety, identity, and whether you feel seen when you walk into a room to ask for help.

Nick Stone understands what it means to arrive somewhere unexpectedly and decide to stay. “I never expected to live in San Diego,” he says. “I grew up across Utah, Arizona, and Wyoming, and as a former military spouse I spent years moving—including some incredible time in Washington, DC. When we landed in San Diego, it just became home. And here we are, more than ten years later.” That sense of settling after constant movement shapes how Nick approaches financial planning. He knows that stability isn’t something everyone grows up with—sometimes it’s something you build intentionally, step by step.

Skyler McCurine’s roots in San Diego run in the opposite direction—deep and wide. “I’m a fourth-generation Southeast San Diegan,” Skyler shares. “I grew up in Encanto. I still live there. My grandparents are in Valencia Park, my extended family throughout Southeast, Barrio Logan, Sherman Heights, and my great aunt in La Jolla back when parts of it were a Black neighborhood.” Skyler’s connection to place brings a powerful understanding of legacy, community, and the long-term impact of financial access—or the lack of it. Together, Nick and Skyler bring lived experience into a space that often feels cold or transactional.

At its core, Edward Jones is about relationships. Strip away the corporate language and what remains is a simple promise: to partner with people to improve their lives, not just their portfolios. “Our teams are committed to fully understanding your financial picture before you make any decisions,” Nick explains. “We’re thoughtful about aligning your goals with a strategy that actually fits your life.” The firm’s values—putting clients first, thinking long-term, and working in partnership—show up in how conversations unfold, not in how fast decisions are made.

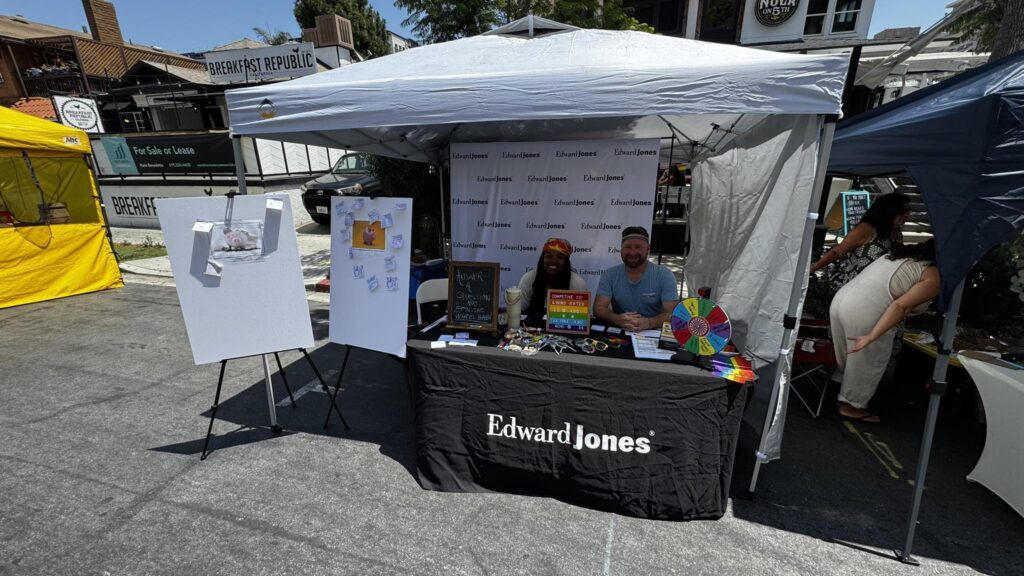

For Nick and Skyler, being visible and active within the LGBTQ+ community isn’t an add-on, it’s essential. As Edward Jones’ Head of Inclusion and Accessibility Vanessa Okwuraiwe says, “Knowing each person’s story builds trust and allows us to serve our clients with care. Leading with authenticity inspires others to do the same and creates the place of belonging we need to unlock the full potential of ourselves, our clients, and our firm.” In practice, that means creating a space where clients don’t have to explain themselves, correct pronouns, or wonder if their family structure will be respected.

That matters more than many people realize. A recent study from the Center for LGBTQ Economic Advancement & Research found that many LGBTQ+ individuals experience discrimination at financial institutions—from being misgendered to being unable to open accounts with spouses. “Our focus is creating a true sanctuary,” Skyler says. “A place where people can breathe. Where they don’t have to brace themselves just to talk about their money.”

The stakes are real. According to the Williams Institute, more than 22% of LGBTQ adults live in poverty, compared to 16% of their straight and cisgender peers—and those numbers increase for Black individuals, people of color, transgender people, and anyone carrying multiple marginalized identities. Lower wages, employment discrimination, lack of family support, and barriers to financial systems all contribute. “These aren’t individual failures,” Nick says. “They’re structural challenges. And acknowledging that changes how we help people move forward.”

The new year often arrives with big financial promises—save more, spend less, get out of debt—and by spring, many of those resolutions fade. A 2023 Forbes Health poll found that over half of people abandon their resolutions by April. “It’s usually not a motivation problem,” Nick explains. “It’s an execution problem.” Vague goals don’t hold. Specific ones do. Saving $100 a month. Increasing a retirement contribution by one percent. Building an emergency fund before anything else.

Skyler encourages clients to start small and focused. “Pick one or two priorities. Not everything at once. Progress builds confidence.” Tracking those small wins matters more than chasing perfection. And having accountability—whether that’s a partner, a trusted advisor, or a team that knows your full story—can make the difference between giving up and staying the course.

When asked to describe their work in a single word, both Nick and Skyler land on the same foundation: the WORD is Trust. “Trust is everything,” Nick says. “You’re asking someone to help guide your future.” Skyler adds another word without hesitation: safety. “Our office is a soft place to land. People come in carrying fear—‘Am I behind? Will I be okay?’ Life hits hard sometimes. You need a space where you can be honest about who you are, what you need, and how you feel. You can’t feel safe without trust.”

This year doesn’t have to be about shame or catching up. It can be about clarity. About taking one real, honest step toward stability. And maybe, for the first time, about feeling safe enough to ask the questions you’ve been holding onto.